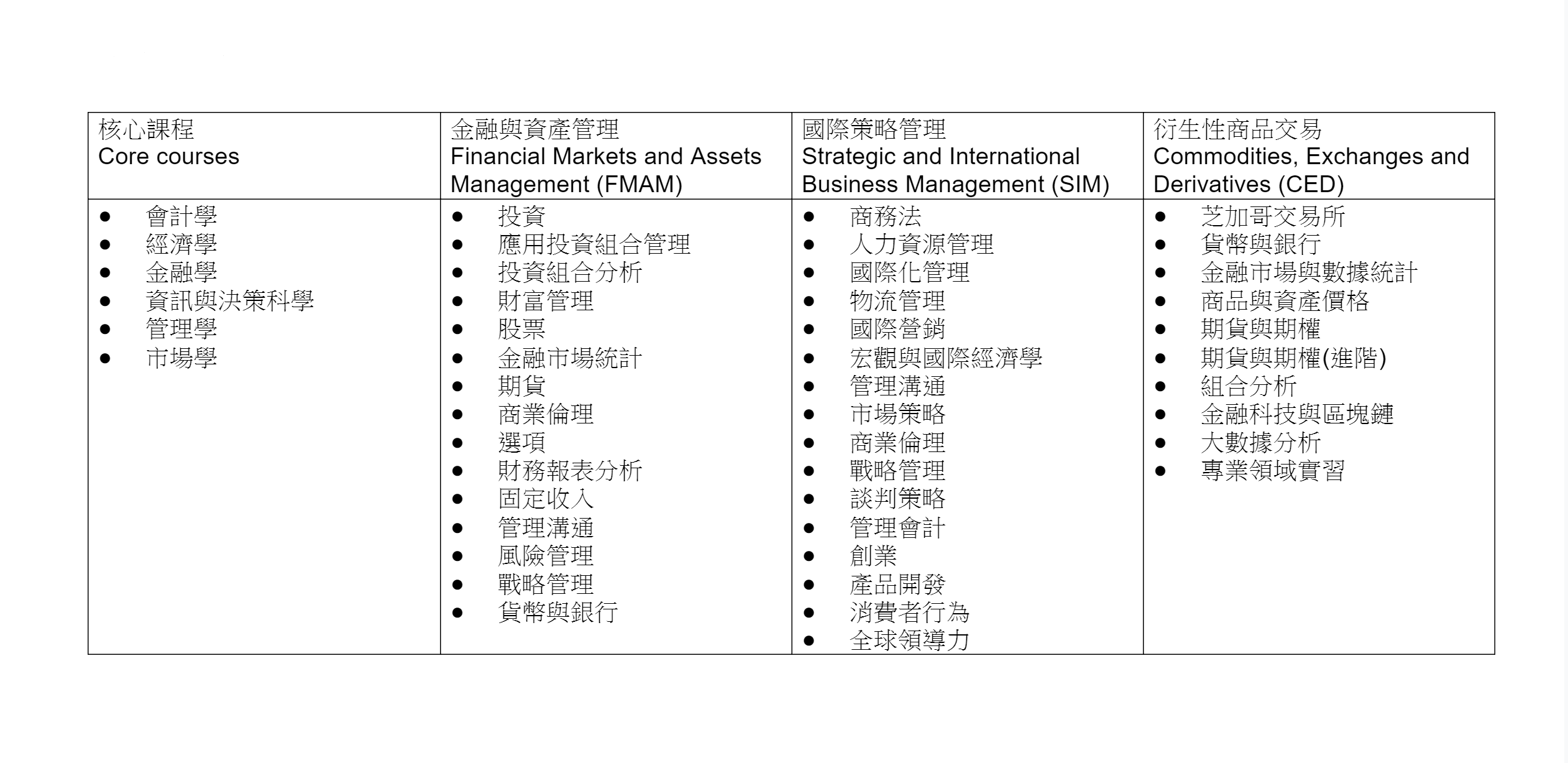

課程內容

core courses

核心課程 Core courses |

金融與資產管理 Financial Markets and Assets Management (FMAM) |

國際策略管理 Strategic and Inter national usiness Management (SIM) |

衍生性商品交易 Commodities, Exchanges and Derivatives (CED) |

|

|

|

|

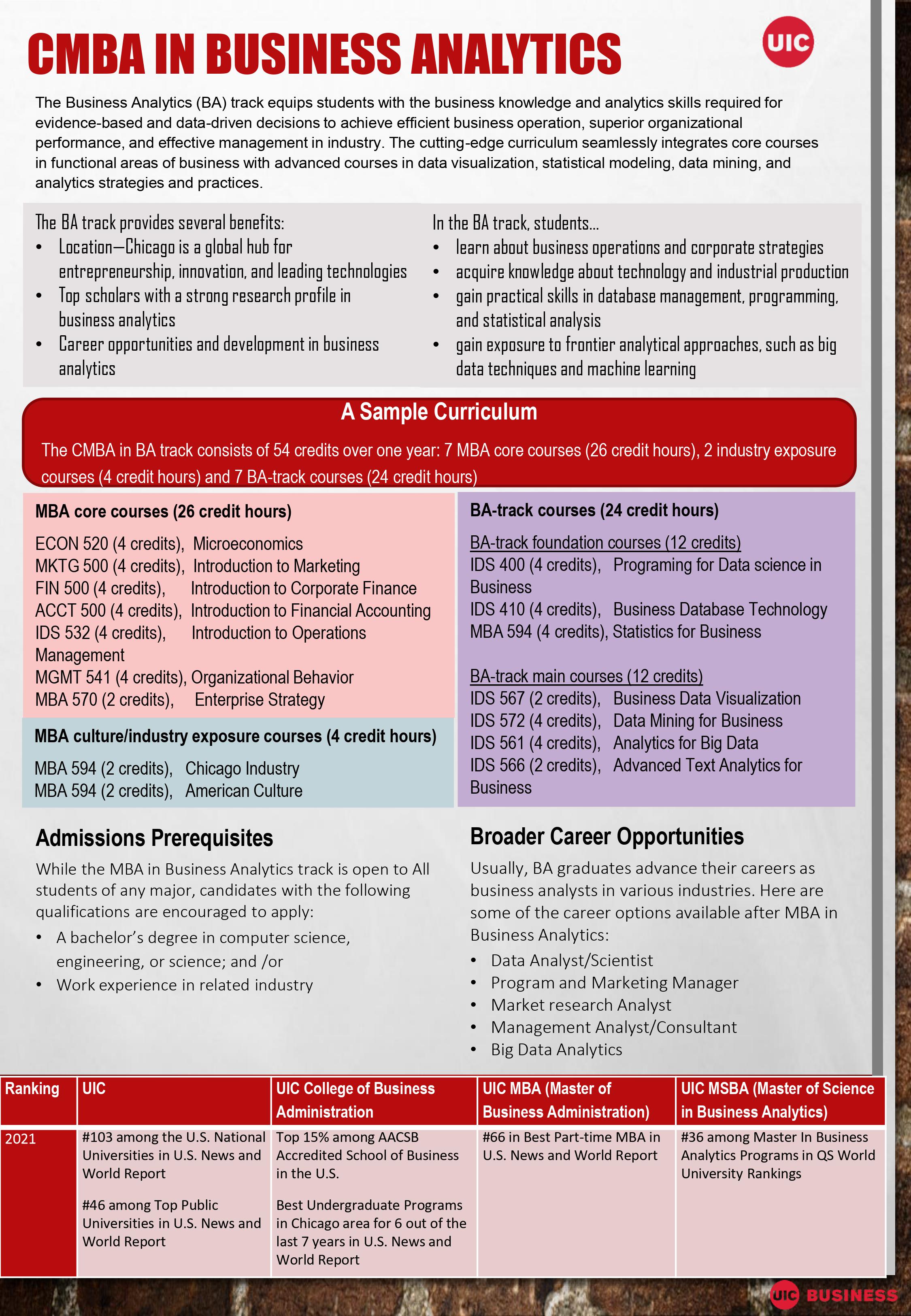

Course content

core courses

The core courses consist of the seven required courses for the program that cover essential knowledge in the business disciplines. Following are brief descriptions of each course:

Introduction to Financial Accounting. Financial accounting: Concepts and principles of financial accounting for preparation and evaluation of external reports and financial statements.

Microeconomics for Business Decision. Efficient allocation of resources by consumers, profit and non-profit firms and government, regulation of industry, monopoly and imperfect competition, business ethics and the marketplace, efficiency vs. equity, social welfare.

Introduction to Corporate Finance. Theory of corporate finance: goal of the firm, time value of money, investment decisions (under certainty and uncertainty), net present value, capital markets, and corporate financing decisions.

Introduction to operations management. The management of operations for the production and delivery of goods and services. Topics include the management of projects, production, supply chain, inventory, and quality.

Organizational Behavior. The organization as a social system. Topics include leadership, interpersonal effectiveness, group behavior, managing change, conflict management, motivation and behavior, and interpersonal communications.

Introduction to Marketing. Client/consumer behavior and the way institutions respond to such behavior through planning, promotion, and distribution of goods and services.

Enterprise Strategy. A capstone course for MBA students which provides frameworks and decision tools to integrate prior course work in a set of analytic and problem solving efforts to address the strategies and enterprise level challenges of firms.

MBA Required courses - 26 credits

ACTG 500 Introduction to financial accounting (4)

ECON 520 Microeconomics (4)

FIN 500 Introduction to corporate finance (4)

IDS 532 Introduction to operations management (4)

MGMT 541 Organizational behavior (4)

MKTG 500 Introduction to marketing (4)

MBA 570 Enterprise strategy (2)

Master of Business Administration in Strategic and International Management (IM)

The MBA program with a focus in Strategic and International Management seeks to foster an understanding of American business practices and culture together with knowledge of the core functional areas of business to allow students to develop their judgment and ability in applying this knowledge in a global business environment.

Ideal candidates for the MBA for Strategic and International Management program are young professionals who have already begun their careers and find it difficult to be away from the workplace for more than one year.

IM Advanced Courses are a minimum of 28 credit hours; representative courses include:

International Business Operations

International Management

International Marketing

International Strategy

Managerial Communications

Business Ethics

Commercial Transactions

Entrepreneurship

Global Leadership Management

Logistics Management

Macro and International Economics

Marketing Strategy

Negotiation Strategy

Strategic Management

The final selection of advanced course work may vary from one cohort to the next.

Master of Business Administration in Financial Market and Asset Management (FMAM)

The MBA program with a focus in Financial Markets and asset Management are designed to further the careers of financial professionals by enhancing their understanding of financial markets, asset management, and the operation of financial institutions in a dynamic global economy. Drawing on the resources of the financial community of Chicago, the programs provide up-to-date knowledge in the theory and practice of financial markets, and asset management.

This program derives a unique advantage from their prime location in the city of Chicago, which is home to the world’s largest options exchange, the Chicago Board Options Exchange (CBOE); the world’s largest futures exchanges, the Chicago Mercantile Exchange Group (CME); and the third largest stock exchange in the United States, the Chicago Stock Exchange (CSE). In addition to these institutions, the Chicago Federal Reserve Bank, other major domestic and foreign banks, large multinational securities, and futures firms all have offices in the city. This environment provides students with many opportunities to interact with leading experts in the industry and to become acquainted with the most advanced technology in the field.

FMRM Advanced Courses are a minimum of 28 credit hours; representative courses include:

Investments

Options

Portfolio Analysis

Futures

Risk Management

Equities

Fixed Income Securities

Applied Portfolio Management

Wealth Management

Statistics for Financial Markets and Risk Management

Business Ethics

Strategic Management

Financial Statement Analysis

Managerial Communications

Master of Commodities, Exchanges and Derivatives (CED)

This focus is designed to provide students with a solid foundation in the core aspects of business and management by completing the same set of core courses as students in any other MBA programs offered at UIC. At the same time, drawing on the unparalleled resources of Chicago - home of the largest derivatives, options, and futures exchanges in the world - an MBA in Commodities, Exchanges and Derivatives provide up-to-date knowledge in the theory and practice within each sub areas of commodities, derivatives, and exchanges. Advanced courses are

a minimum of 28 credit hours taught by both UIC's faculty publishing cutting-edge theories in their fields and leading experts in the industry like executives from CME and CBOE.

Representative advanced courses include:

• Chicago Exchanges

• Money and Banking

• Statistics for Financial Markets

• Commodities and Asset Pricing

• Futures

• Options

• Futures and Options, Advanced

• Portfolio Analysis

• FinTech and Blockchain

• Big Data Analysis

• Field Coursework

The final selection of advanced course work may vary from one cohort to the next. Program Prerequisites

Prior study of calculus and statistics is highly recommended.

https://business.uic.edu/cmba/?fbclid=IwAR3MhWFVzCQ71-Ey9IPe-ZYEcNEXwVfDRie4rCoJj0wtffq8_v-AzU5zYX8